april 2016 service tax rate

From 142016 service tax is leviable on 30 on amount charged for service of transport of passengers by rail without availability of cenvat credit of inputs and capital. Budget 2016 has proposed to impose a Cess called the Krishi Kalyan Cess 05 on all taxable services.

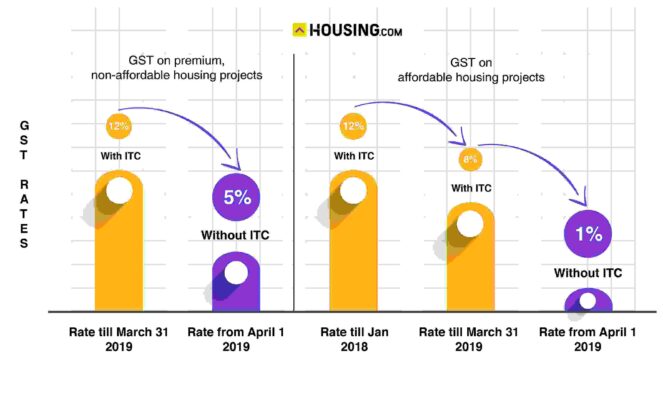

Gst On Flat Purchase Real Estate Rates In 2022 Impact On Home Buyers

15 percent and 28 percent.

. Service tax rate increased from 145 to 15 increase by way of levying Krishi Kalyan Cess at 05. The service tax rate may get changed by Budget 2016 from 145 to 16. Service tax is only liable to be paid in case the total value.

If a new levy is introduced like Krishi Kalyan Cess or a service taxed for first time then Rule 5 is to be. 2 There shall be levied and collected in accordance with the provisions of this Chapter a cess to be called the Krishi. Earlier this is applicable for Services of goods transport agency.

The Said change will be effective from 1st June 2016. Service tax rate increased from 145 to 15 increase by way of levying Krishi Kalyan Cess at 05. THIS BOOKLET DOES NOT CONTAIN TAX.

Cenvat Credit of Input Input Service Capital Goods used for providing the said service is not availed. 132016-ST dated 1-3-2016 effective. 42 1430 435 14530 45 1530 Effective from 01042016 a uniform abatement at the rate of 70 is prescribed for services of construction of complex.

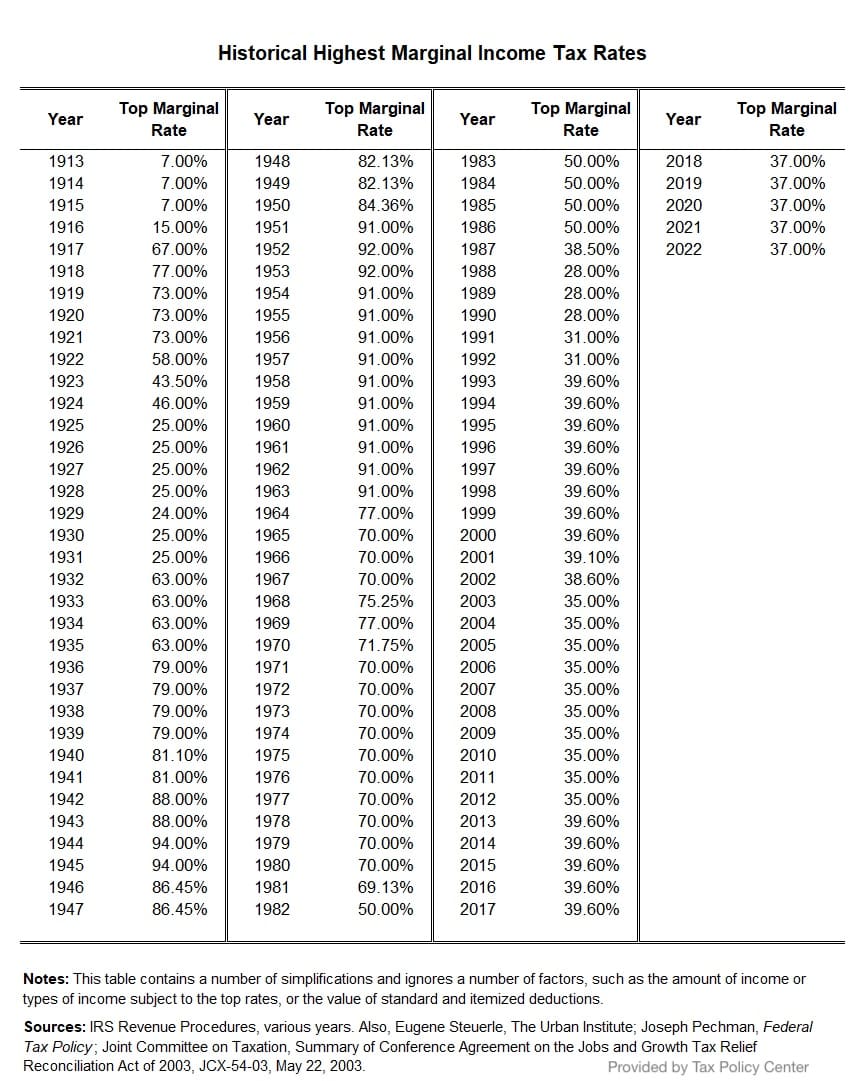

Krishi Kalyan Cess is proposed to be levied from 162016 05 on the value of such taxable services. New Service Tax Chart with Service Tax Rate of 15. However taxable income over certain levels was.

Department of the Treasury Internal Revenue Service IRSgov This booklet contains Tax Tables from the Instructions for Form 1040 only. From the 1st of June 2016 service tax is levied at 15 of the value of taxable services under Section 66 of the Service Tax Act. Get the benefit of tax research and calculation experts with Avalara AvaTax software.

For detail article about service tax changes applicable from 1416 read here. Ad Avalara AvaTax can help you automate sales tax rate calculation and filing preparation. The new effective service tax could henceforth be 15.

In addition to the basic rate of 12 Education Cess at the rate of 2 and Secondary and Higher Secondary education Cess at the rate of 1 are levied on service tax. 1 This Chapter shall come into force on the 1st day of June 2016. SERVICE TAX RATE CHART 2016-17 PDF DOWNLOAD SERVICE TAX RATE CHART 2016-17 PDF READ ONLINE 2016-17 tax rates - Pooled development funds PDFs see note 2.

Changes in service tax Budget 2016. For the tax payers with value of taxable service less than 60 lakh rupees in PFY interest rate for delayed payment will be. Service tax rate 145 is applicable for period during 142016 to 3152016.

Cenvat credit on input input services and capital goods are not available. However if assessee has collected service tax but did not deposit it with Government interest rate will be 24 Notification No. You may also be interested in using our free online 2016 Tax Calculator which automatically calculates your Federal and State Tax Return for 2016 using the.

Tax Rates 2016 1 For Tax Years 1988 through 1990 the tax rate schedules provided only two basic rates. In exercise of the powers conferred by section 109 of the Finance Act 2015 No. Service Tax Interest Rates wef 14052016 Other than in above situations.

Simple Interest Rate 15 NOTIFICATION NO132016-ST DATED 1-3-2016 Service Tax Interest. Changes applicable from 1st April 2016. The 15 includes 05 Krishi Kalyan Cess and 05 Swach.

20 of 2015 the Central. 01062016 30062017 15 14 Service Tax 050 Swach Bharath Cess 050 Krishi Kalyan Cess Small scale exemption. Awarded Global Tax and Legal.

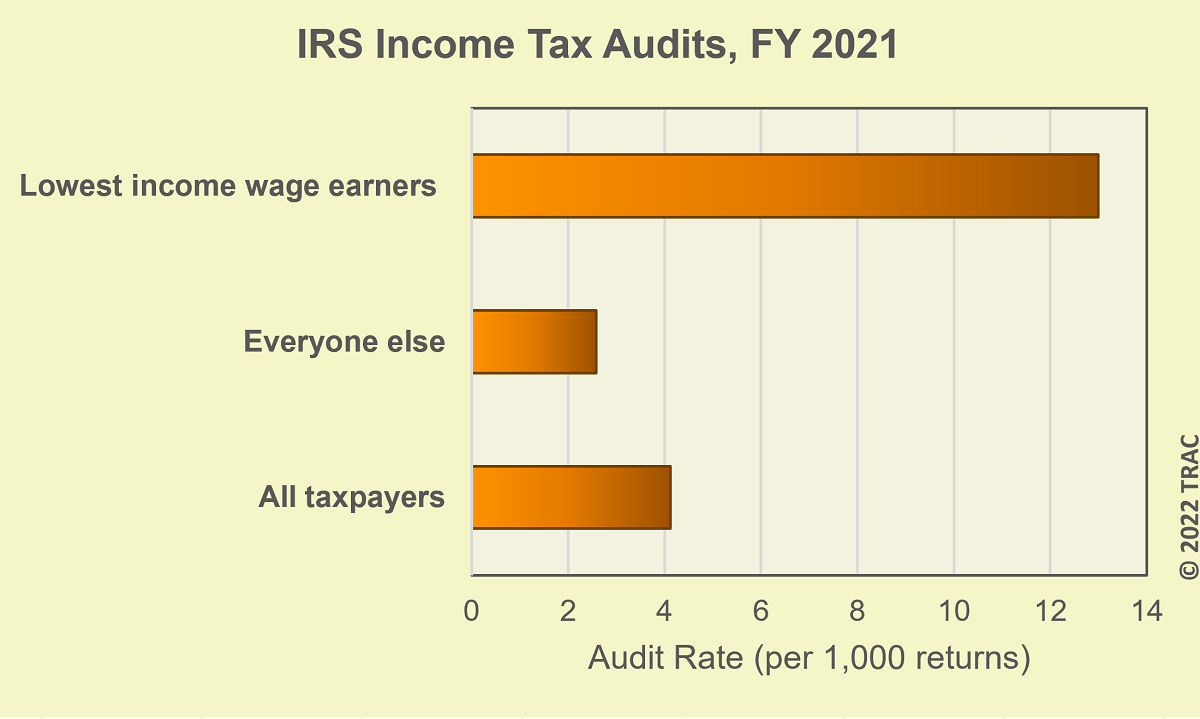

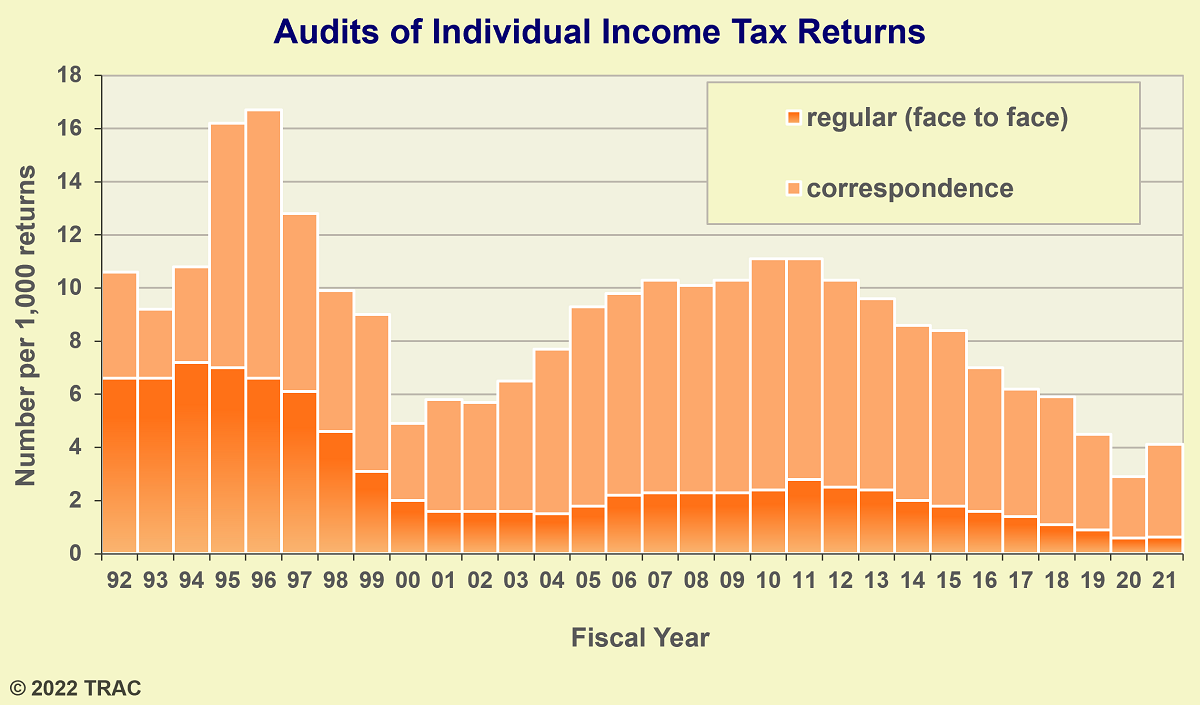

Irs Audits Poorest Families At Five Times The Rate For Everyone Else

Tax Day Is Coming Soon Here S What You Need To Know About Filing Your 2021 Taxes Cnn Business

The Impact Of Gst On Varied Business Areas Gst Gstbill Business Tax Goods And Service Tax Business Challenge

Types Of Taxes Income Property Goods Services Federal State

Income Tax History Tax Code And Definitions United States

Tax Deadline 2022 How Long Is The Tax Extension For 2022 As Usa

Irs Audits Poorest Families At Five Times The Rate For Everyone Else

Tax Principles Relx Information Based Analytics And Decision Tools

Interaction Of Household Income Consumption And Wealth Statistics On Taxation Statistics Explained

Pin On Inventory Management Software India

2016 Tax Bracket Rates Bankrate Com

Interaction Of Household Income Consumption And Wealth Statistics On Taxation Statistics Explained

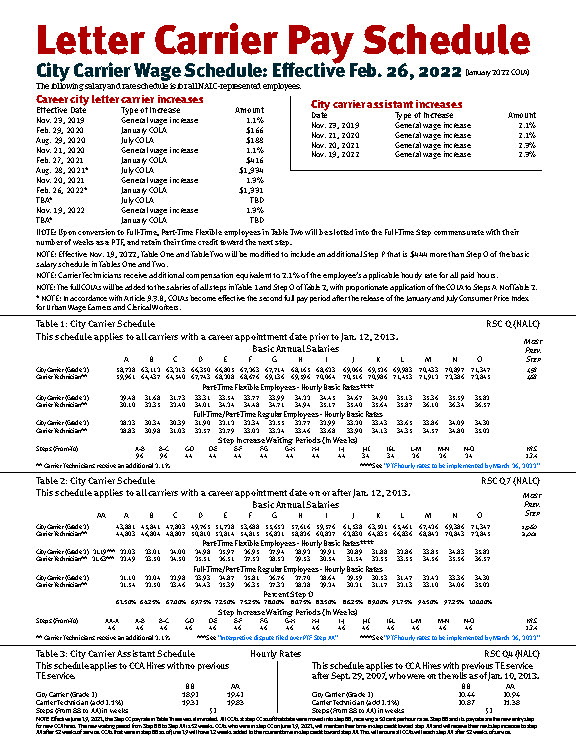

Pay Tables Cola Info Annuity Projections National Association Of Letter Carriers Afl Cio

When Are Taxes Due In 2022 Forbes Advisor

How Does The Deduction For State And Local Taxes Work Tax Policy Center